College life is costly. Between social events, food, drinks, and unexpected expenses, saving money seems impossible. And if you’re living in accommodation, the costs are only higher.

In this article, I’ll share strategies to help you save money effortlessly, score the best deals and discounts, and still enjoy college life without compromising on essentials.

1. Look for deals when shopping

- Club-card prices: Do you’re weekly shopping from Tesco and avail of their special Clubcard prices – you could save up to €40 every month.

- Shop in the evenings – Items tend to be heavily discounted in the evening to get rid of stock. Shop after 6 pm.

- Cheaper shops – Shop from places like Lidl, Aldi and Tesco. They are the cheapest.

- Look for reduced prices – Many shops sell products much cheaper when it’s getting close to its sell-by-date. Look out for these!

Getting the best deals will save you a lot of money weekly.

2. Save up to €1500 a year on groceries

By switching to the store brands, you can save up to €1500 a year. The generic (store) brands are up to 70% cheaper than other brands.

- Ketchup: Save nearly 70% from switching to Tesco brand compared to Heinz

- Cornflakes: Tesco brand is about 62% cheaper

- Washing powder: Save about 50%

Simple changes can save you a lot of money.

3. Make coffee at home

This my least favourite one on the list, but perhaps the most effective. By making coffee at home, you could save up to €600 (assuming you buy coffeeat least 3 times a week).

TIP: If you are to buy coffee, buy it from places with deals. For example, Insomnia have a loyalty program where every 10th coffee is free.

4. Get rewarded on your birthday

Your birthday comes once a year, so get rewarded for it! Go to restaurants that have deals and discounts for your special day.

Restaurants:

- Captain America’s – Free meal on your birthday when you sign up for their loyalty program

- Eddie Rocket’s – Free burger with a birthday voucher (sign up required)

- Starbucks – Free drink or treat for Rewards members

- Hard Rock Cafe Dublin – Free dessert on your birthday

- Costa Coffee – Free cake for Costa Club members

Clothing/cosmetic shops:

- River Island: Offers a birthday discount for members of their loyalty program

- Rituals: Loyalty members get a birthday gift or special offer during their birthday month (I can personally vouch, being a rituals member has a lot of benefits!)

- Boots: Birthday rewards for members of their Boots Advantage Card program.

Take advantage of your birthday!

5. Buy in bulk and freeze

Get bigger quantities. The most common items you can buy in bulk are:

- 24 pack of toilet paper instead of 6

- 24 eggs

- Tub of mayonnaise or ketchup

- Oil

- Pasta

Basically, you can bulk buy most non-perishable items. Doing this will save you approximately €15 per month.

Once you buy in bulk, freeze the items. You can freeze essentials like bread, pasta, milk, cheese etc.

PRO TIP: Cook meals in bulk and freeze them – will save you a lot of time.

6. Bring packed lunches

Instead of buying lunch regularly, get a packed lunch. A simple sandwich with fruits. Easy to make, and cheap to make.

Getting a packed lunch could easily save you anywhere from €60 to €100 per month, depending on your lunch habits.

PRO TIP: Treat yourself to a bought lunch once a week. Get your favourite dish every Friday.

7. Sign up to UNiDAYS

UNiDAYS is a free digital platform that provides students with exclusive deals and discounts on your favourite brands.

All you have to do is sign up with a valid student ID – and the discounts start rolling in. Below are some of the brands you can get discount from by using UNiDAYS:

Fashion:

- Nike: 10% discount on any purchase

- Shein: 15% discount

- Life Style Sports: 10% discount and next-day delivery

Beauty:

- Rituals: 15% discount

- The Perfume Shop: 15% discount

- HQhair: 20% discount

Food:

- Dominos: 35% offwhen you spend €25+

- Krispy Kreme: 12% discount

8. Ask for student discount

Wherever you go, ask for student discount.

You can save up to 10 – 20% by doing this. Below are the best places to use your student discount:

- Nando’s: Offers a 20% discount on food from Monday to Wednesday when you link your student email to your Nando’s account.

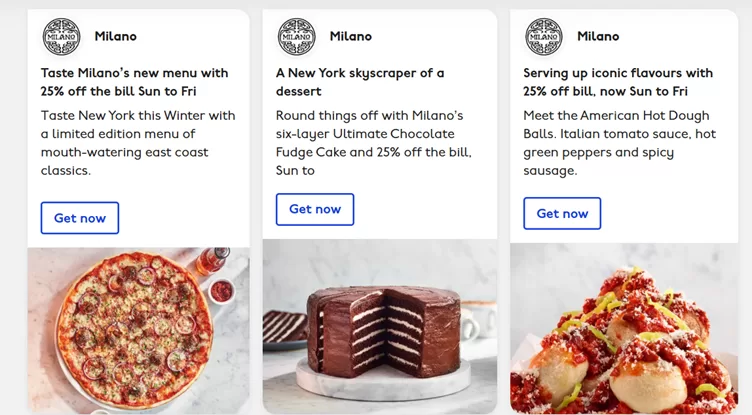

- Milano: Provides a 25% discount on food and drinks from Sunday to Thursday for students registered with UNiDAYS.

- Captain America’s: Any main menu item, hand-cut fries, and a soft drink for €9.95, available Monday through Friday with a valid student ID

- Boots: Provides a 10% discount for students who are Boots Advantage members and present a valid student ID.

- Spotify: Only €5.99 a month with student discount.

9. The 30 days saving challenge

If you want to save money at the end of the month, try this simple 30 days saving challenge.

Challenge: Save a euro every day. Either put away one euro in a saving account every day, or store it in a piggy back.

Every day for 30 days, find places where you can avoid spending money, and instead, save it.

If you do this, you would’ve have saved €30. The next month, repeat the challenge, but save €2 every day.

10. The Spare Change challenge

If you have a revolut account, this is for you.

Revolut’s Spare Change feature helps you save effortlessly by rounding up your card transactions to the nearest whole number and allocating the difference to a designated savings account.

For example, if you buy a coffee for €2.50, Revolut automatically rounds up and puts the extra 50 cents in a savings account.

NOTE: Only do the above 2 challenges if it’s possible. Saving money is important, but you shouldn’t be in a position where you are unable to buy essentials.

11. Look for part-time jobs

Look for part-time jobs on campus, or online. These are a great way to make some extra money in your free time.

- On-campus jobs: jobs like library assistant, student ambassador, or part-time in one of the restaurants or cafes on campus.

- Tutoring: If you’re skilled in a particular subject, or are comfortable with Leaving Cert subjects, consider becoming a tutor. Platforms like Kumon and Superprof are great options.

- Pet sitting: If you’re neighbour or anyone you know has any pets, no harm asking them if they need a pet sitter.

- Online jobs: There are tons of online jobs that pay well. Read this article (link savethestudent)

- Get an online internship to boost your skills

With a part-time job, you can easily be making €100+ every month (this number can be much higher!).

Finding time to do a job in between studies is difficult. Read our article on ‘How to be better with time management’ to help you with this!

NOTE: While part-time jobs are a great way to earn extra money, it’s important to remember that your academic responsibilities should come first. Don’t feel pressured to work too many hours that could affect your studies or overall well-being. Always consider your course load, exam schedules, and personal health before committing to a job.

12. Don’t waste money on costly subscriptions

It’s easy to sign up to subscription services. But these expenses pile up quick.

Only get a subscription-based service if you really need it (we all need Netlfix!). And when you do, look for the best deals, like the ones below:

Notion:

If you want a productivity tool integrated with AI, Notion is for you. Notion is a free (or low-cost) productivity platform that will help you organise your assignments, projects, and help you take effective notes.

The free plan offers amazing features, and if you need more, their premium plans are affordable for students.

We earn a commission if you click this link and make a purchase, at no additional cost to you.

Coursera:

If you want to boost your skills – and not pay a heavy price to do so – consider coursera. They have thousands of courses in different disciplines – for a reasonable price.

Doing online courses is the perfect way to boost your CV and make yourself stand out amongst the crowd.

Check out my review on some amazing courses you can try:

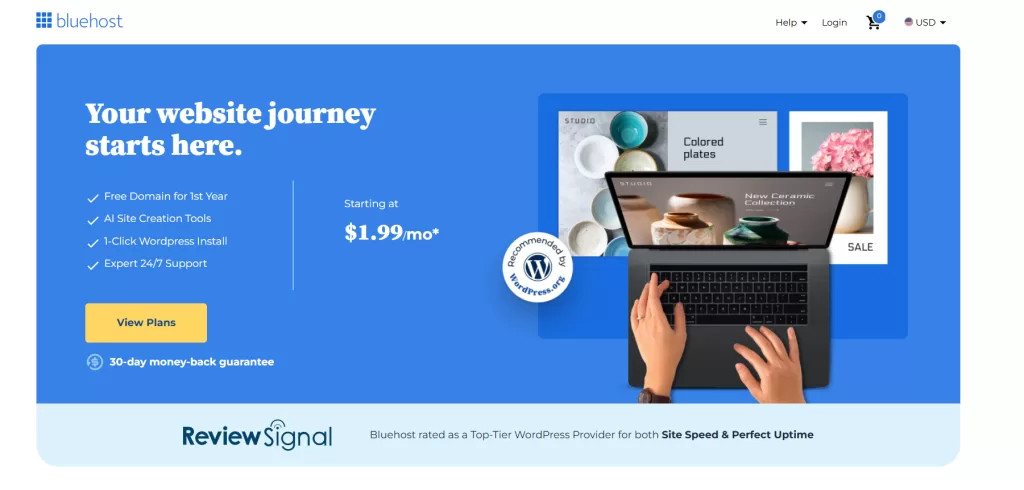

13. Start a website

Starting a website is the perfect side hustle, and a fun hobby too. And, it’s super easy too.

Here’s why you should start a website:

- Build your personal brand: Stand out to potential employers or clients.

- Earn money: If you’re entrepreneurial, a website can become a source of income through ads, affiliate marketing, or selling products.

- Learn new skills: You’ll learn about marketing, web development, and many more such skills by starting a website.

Affordable Hosting: Get Started with Bluehost

Hosting a website isn’t super costly, especially if you do it with Bluehost. We have partnered up with Bluehost – meaning you will get the best deals!

Read our full review of Bluehost to learn more!

14. Take advantage of free events:

Join societies and clubs – they are the best place to meet new friends. Best of all, most events have free food at the end too.

Go to events that promise free food – it’s a solid strategy to save money.

Conclusion

Budgeting doesn’t mean cutting out all the fun—it means being smart with your money so you can enjoy college without financial stress.

If you found these tricks useful, check out more of our articles!

📢 Look for our posters around campus and scan the QR code to access our tips and tricks for surviving college.

🤝 Share this article with your friends.

Post Disclaimer

Hey there, thank you for reading this article. Just a quick note – this article is meant to offer general tips and ideas, not financial advice. These are the strategies that have been helping me save money in college, but it’s important to take your own situation into account when applying them. Thanks!