How to make a budget and prepare an analysed cashbook

Making a budget is really important when you are trying to save money. This is an essential step towards having better finances, and understanding how to make a budget is really vital for students as well. There are several benefits of making a budget. In this article we will share the information on how to make a budget, and ways in which you can stick to it. We will also provide you with a free download on an analysed cashbook so you can record your finances!

What is a budget?

Before learning how to make a budget, it is important to understand what a budget really is. Simply, a budget is a record of your finances for a given week/month/year. You record your income (earnings/pocket-money/gift amount) and expenditures (spending) in a budget. Making a budget is a common practice both in businesses and households.

Reasons for making a budget?

The main reasons for creating a budget are:

- To monitor spending.

- To see if you need to more.

- It helps you have more money.

- Helps you understand your finances.

- Lets you know if changes are needed in the budget

Just looking at these reasons, you can start to realise how important creating a budget is.

But if you still aren’t convinced, here are some benefits of creating a budget for students:

- You can save money that you couldn’t before.

- You can learn about finances, if that interests you.

- You can get practice creating a budget for the future (because you will need it!)

- You can indulge on things with the money you saved.

- You will learn to reduce opportunity cost.

Now that you are convinced (hopefully!), let’s start the process of creating a budget!

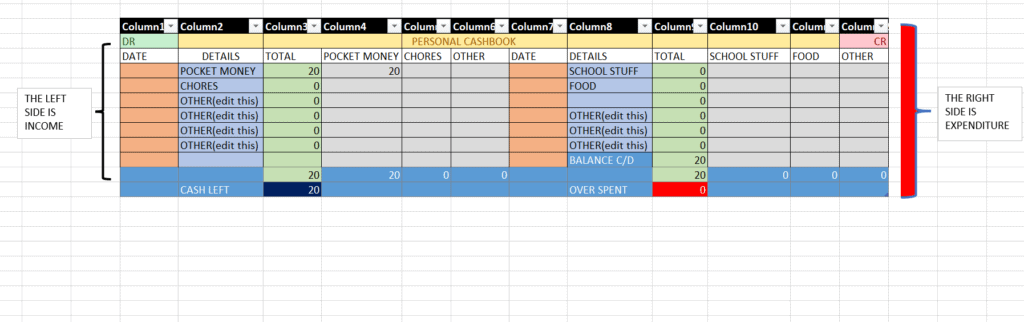

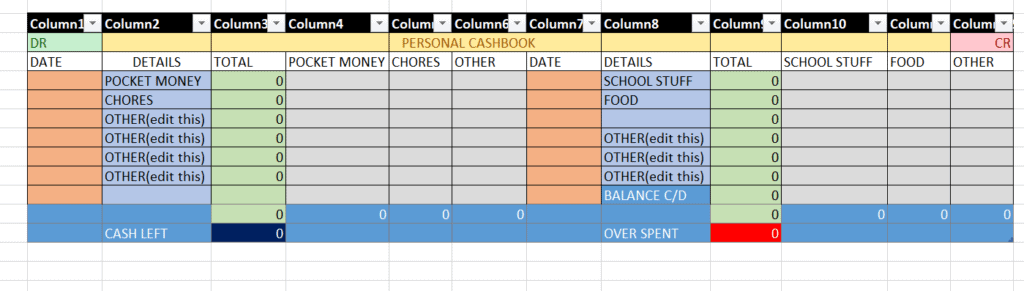

To make your budget, we will be using something called an analysed cashbook. Don’t worry, using this isn’t difficult! It is basically a spreadsheet that allows you to record all of the money you earn and spend, and lets you know whether you’re saving money or going in loss.

Below is a free download of an analysed cashbook created on excel, so you won’t have to do any calculations!

What is an analysed cashbook?

It is a spreadsheet that allows you to record all of the money you earn and spend, and lets you know whether you’re saving money or going in loss. Using it is very simple, and the one we have provided (which you have hopefully downloaded by now!) is extremely beginner friendly. On the left side, you list all your income and the expenditure goes on the right.

Once you have listed all income and expenditure and inserted values, all the calculations will be instantly done and you will get to know whether you are in loss or profit. As simple as that!

Note: Some adjustments have been made to the cashbook, just to make it beginner friendly.

How To Make a Budget?

- Identify your income and expenditure

- Make a list of all your needs and wants

- Identify what you want to achieve with the budget

- Insert all income and expenditure in budget

- Analyse the budget and make any changes

Identify your income and expenditure:

Knowing the sources of your income and expenditure is essential. The first step involved in creating a budget is listing all sources of income and expenditure. You might be thinking, how do you know what you are going to earn and spend before you even do it? It’s simple, list all possible sources of income and expenditure. This list will not always be accurate as you might end up spending money on something else, but this way, you will at least know how much money you are likely to save.

Make a list of all your needs and wants:

Your needs and wants are both sources of expenditure. You should always prioritize your needs over wants, even though that might not be the most ‘fun’ thing to do. Some examples of needs for students can be, buying food, clothes, school supplies, place to live (if in college) etc. Examples of wants are, buying designer clothes, eating in a restaurant, buying a new phone etc. I would suggest that before you start listing your needs and wants, set a specific amount you are willing to spend on needs and wants, then insert them into your budget.

Identify what you want to achieve with the budget:

Now that you know your income, expenditure, needs and wants, it is time to consider what needs to be achieved with this budget. Your goal with this could be to save money (to probably be something expensive) or to just not go in debt. Once you set your goal with this, make changes to the budget accordingly. This can mean cutting back on expenses or looking for ways to increase income. Make all necessary changes!

Insert all income and expenditure in budget, and analyse the budget:

Once you have followed the last step and revised the allocation of money, insert all values into the budget. If you are using the spreadsheet we have provided, you will get to know in the bottom whether you have saved money or are in debt. If it is the latter, you need to start making changes. Keep on reading and you will learn how to make changes to the budget.

These are all the steps required to make a proper, functional budget. If you have followed these steps and reached till here, congratulations! Your budget is complete.

Note: Insert all your income and expenditure in the gaps below, to make it easy, we have labelled the gaps for you!

5 ways to stick to a Budget:

1. Remember what’s on the budget

When buying anything, remember the allocated amounts put on your budget. This way, you will not be tempted to buy something you can’t afford.

2. Limit your credit card usage, if possible

Limit your credit card’s usage.

3. Avoid doing window-shopping

As fun as window-shopping sounds, it really isn’t. When you just browse around shops, you get tempted to buy something absolutely unnecessary. Limit window shopping.

4. Follow a strict routine

When you follow a strict routine, you will not be tempted to overspend. Just for a few weeks, stick to a timetable.

Helpful articles:

How to be better at time management

5. Don’t give up!

No matter what, do not give up on sticking to the budget. It will be tough to do at start, but doing this will benefit you greatly in the future!

You have all the materials required to make a budget and follow it, so don’t wait around, go make your budget right now!

Sanidhya, your initiative Student Expresso is a fantastic platform by students, for students. It is a web log where in students and educators can collaborate and learn!! Keep up the good work, Sanidhya!!

Best website I have ever come across! The content and resources are amazing and the honesty with which the articles are written is truly magnificent. I have been benefited from this website hugely. I have been looking for a site like this, that is constantly providing free resources and tips. Thank you so much for these articles!